What if you woke up to find that your investments had taken a nosedive overnight? It’s a scenario that many faced recently when the news of Trump’s tariffs sent shockwaves through the stock market. You’re probably wondering how this came to be and what it means for you and the global economy. Let’s unravel this situation together.

Understanding Tariffs

Tariffs are essentially taxes that governments impose on imported goods. You can think of them as a way of making foreign products more expensive, thereby encouraging consumers to purchase domestically produced items instead. In the case at hand, President Trump announced new tariffs that could alter the economic landscape significantly.

The Immediate Effects of Tariffs

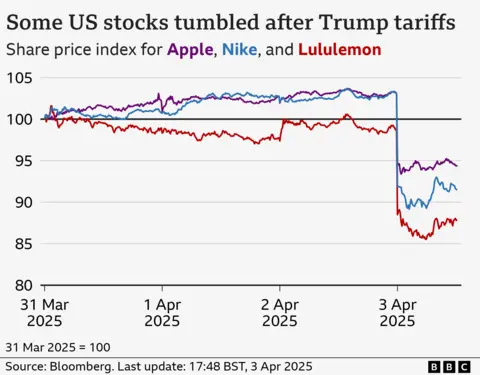

When tariffs are introduced, they usually trigger a cascade of reactions in the stock market. Immediately, stock prices may fall as investors panic about the potential impact on profits and consumer spending. In this instance, after Trump’s announcement, major companies like Nike, Apple, and Target experienced declines of more than 9%. It’s almost like watching a domino effect in real-time; one decision leads to another, and before you know it, everything is spiraling downwards.

Stock Market Reactions

The Dow Jones and S&P 500 indices, which you might recognize as barometers of American economic health, faced their steepest declines since the COVID-19 pandemic began in 2020. The S&P 500 saw a drop of 4.8%, losing roughly $2 trillion in value in just one day. This is alarming for anyone invested in the markets, as these shifts can significantly impact retirements, savings, and investments.

Global Repercussions

You might assume that these tariffs would only affect the United States, but international markets also felt the tremors. Stock markets in Japan, South Korea, and Australia also dipped in response. So, if you’re worried about your global investments, you’re not alone. The interconnectedness of economies means that what happens in one country can have ripple effects across the world.

The Retaliation Game

China and the European Union expressed their own concerns about the tariffs, vowing to retaliate. Imagine if you were playing in a soccer match and one team suddenly changed the rules; the other team wouldn’t just stand by and accept it quietly. Both China and the EU could impose their own tariffs, which would ultimately create a cycle of retaliation that raises prices for consumers everywhere.

The Broader Economic Landscape

The World Trade Organization (WTO) stepped in with a warning: tariffs could shrink global trade volumes by about 1%. If you consider that trade affects everything from job creation to consumer prices, this should truly raise your eyebrows. When goods become more expensive, consumers often pull back on spending, which can lead to slower economic growth.

The Consumer Impact

As tariffs rise, so too does the cost of goods. If you think about it, many companies may end up passing those additional costs on to you, the consumer. This is a crucial point because U.S. consumer spending amounts to a staggering 10-15% of the entire world economy. If consumers start spending less due to higher prices, the economic effects can be dire.

What Happens to Prices?

So, if companies like Nike and Apple face increased tariffs, they need to decide: absorb the costs, share the burden with partners, or pass the costs directly to consumers. For you, this could mean paying higher prices for everything from your favorite sneakers to the latest tech gadgets.

Economic Warnings

Experts are warning that these tariffs could lead to inflation, which means that the value of your money decreases over time. When prices rise, you find that your dollar doesn’t stretch as far as it used to, impacting your overall purchasing power. Seema Shah, Chief Global Strategist at Principal Asset Management, pointed out that without other changes, like significant tax cuts, a recession might be on the horizon.

Manufacturers in a Bind

For manufacturers, high tariffs can lead to significant disruptions. For example, Stellantis, the company behind iconic brands like Jeep and Fiat, announced it would halt production in certain factories due to the new tariffs on car imports. This can lead not only to factory closures but also to layoffs, making it a double whammy for the economy and for employees.

Market Resilience: A Silver Lining?

Despite the chaos in the stock market, some markets still showed resilience. Gold prices surged, reflecting a shift where investors often gravitate toward safer assets in times of turmoil. You might consider how you want to manage your investments during such periods of uncertainty.

Consumer Sentiment: Mixed Feelings

It’s also essential to gauge the mood of consumers as these changes roll out. Some may see these tariffs as a necessary evil aimed at boosting domestic manufacturing, while others perceive them as detrimental to their wallets. Polling shows a mixed bag of responses, illustrating just how deeply personal and varied opinions can be on economic matters.

Long-Term Implications: What’s Next?

You might find yourself wondering what the long-term implications of these tariffs could be. While President Trump remains optimistic about a manufacturing boom, experts warn that transformational changes in manufacturing often take years. The immediate concern is how these tariffs might stifle economic growth in the short term, with lasting effects felt for years to come.

Strategies During Economic Uncertainty

As you navigate this fluctuating economic landscape, consider re-evaluating your investment strategy. Do you lean toward riskier assets or prefer the safety of commodities like gold? Perhaps it’s time to enhance your financial literacy regarding tariffs and their effects on the economy, ensuring you’re not merely reacting to market movements, but strategically investing for the long haul.

Diversification: Your Best Friend

One effective strategy is diversification – spreading your investments across different sectors. This way, if one sector takes a hit due to tariffs, it won’t sink your entire portfolio. If you’re invested in tech, for instance, consider balancing it out with commodities, bonds, or even real estate.

Planning for Uncertainty

If there’s anything to take away from this scenario, it’s the importance of being prepared for uncertainty. No one can predict market movements with absolute confidence, but by staying informed about global economic policies and their implications, you’re setting yourself up for better decision-making down the line.

The Role of Research

Investing can be as much about the numbers as it is about human behavior. Spend some time reading up on how tariffs can affect different sectors and get a feel for expert opinions. In this digital age, information is abundant, so leverage it to construct a well-rounded financial plan.

Conclusion: Keeping Your Eyes Open

In summary, the announcement of new tariffs by President Trump has already had significant implications for both the stock market and consumer behavior. While it may feel overwhelming, remember that you’re not alone in navigating these challenges. Stay active and informed, keep your investment strategy resilient, and be prepared for the unpredictable waves of economic change. By being proactive and adaptable, you can safeguard your financial future against the uncertainty that accompanies changes in market conditions.